Last modified: July 10, 2024

Profit dispensaries

Making a profit from patient orders

Dispensary owners can choose to earn a profit from patient orders placed through their dispensary and receive earnings via direct deposit to a bank account. With a profit account, you unlock additional patient discounts, become the seller of record, and take on responsibility for reporting your income at the end of the tax year. Fullscript maintains all sales tax responsibilities at the state level for you.

To start earning a margin of patient orders, we’ll need the following to set up an account with our payment processor, verify your identity, and enable payments:

- Your legal name, date of birth, and physical address for identity verification purposes.

- US accounts: Last 4 digits of your social security number (SSN). Be aware that you may be required to enter your full SSN to verify your account successfully.

- Canadian accounts: Full social insurance number (SIN).

- Business accounts: Employment identification number (EIN) or business number (BN).

- Your tax classification.

Tax implications

Profit account holders become the ‘seller of record,’ inheriting the responsibility to report income earned from Fullscript to the Internal Revenue Service or Canada Revenue Agency come tax season. Sales tax responsibility at the state level is maintained by Fullscript.

Dispensary & patient discounts

Dispensary discounts apply to all patients in your dispensary and are stackable with individual patient discounts. Both discount types apply to all products in your dispensary. The maximum discount available to patients can’t exceed the maximum discount available for your region (35% in the US and 25% in Canada).

Patient discounts are applied individually to specific patients from the Patients list, and or you can edit patient level discounts in bulk using the Bulk discounts editor.

An Autoship & Save discount, which is applicable only to patients who activate an Autoship, can be set up from the Business financials page. It’s also stacked with dispensary, patient, or promotional discounts, up to the maximum discount in your country.

Adding bank accounts

A bank account must be provided to enable direct deposit payouts. We’ll ask you to enter a bank account if you choose to set up a profit account. Payouts can only be deposited to a single bank account.

Receiving your payouts

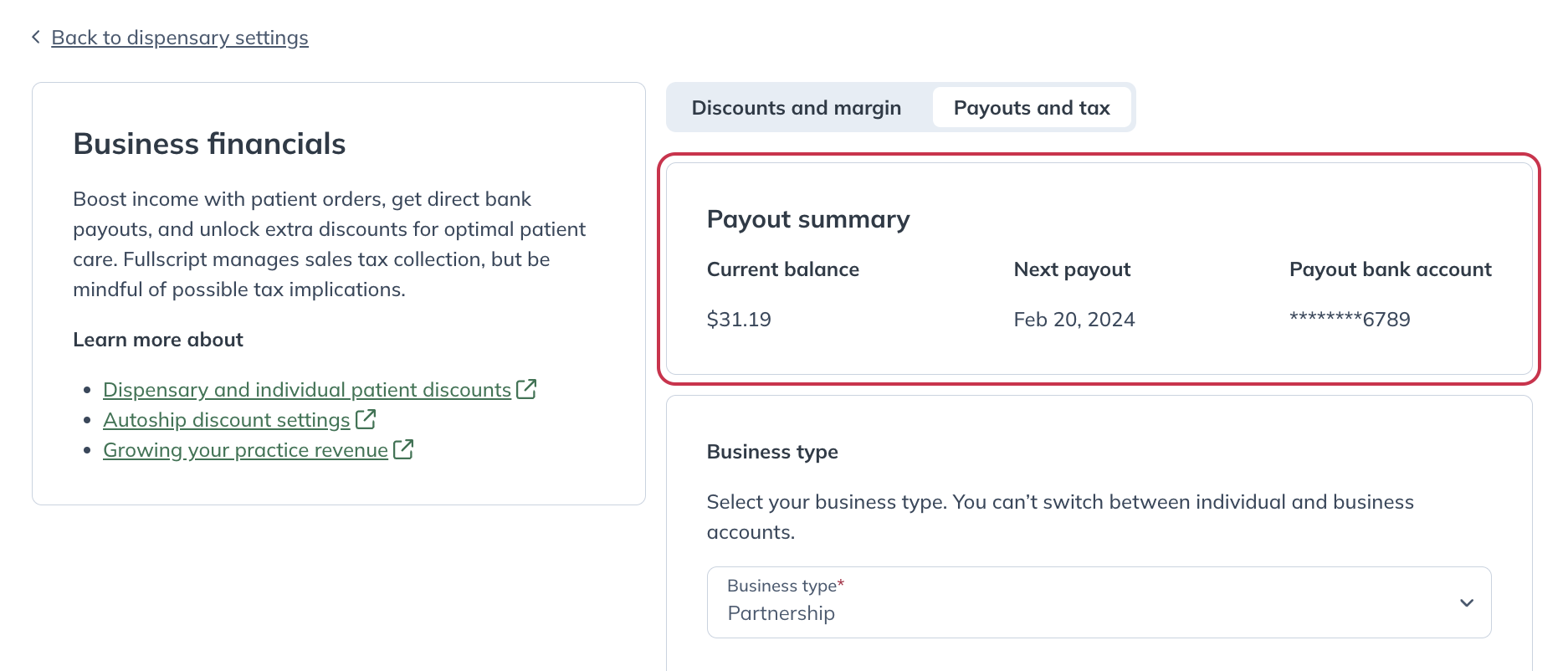

Earnings accumulate as orders ship and are deposited directly to your active bank account on your next payout date. View your current balance, payout bank account details, and your next payout date on the Business financials page.

After your first successful payout, you can access the Reports page from the practitioner menu (click your initials or avatar to view this menu).

Setting up a margin account (make a profit)

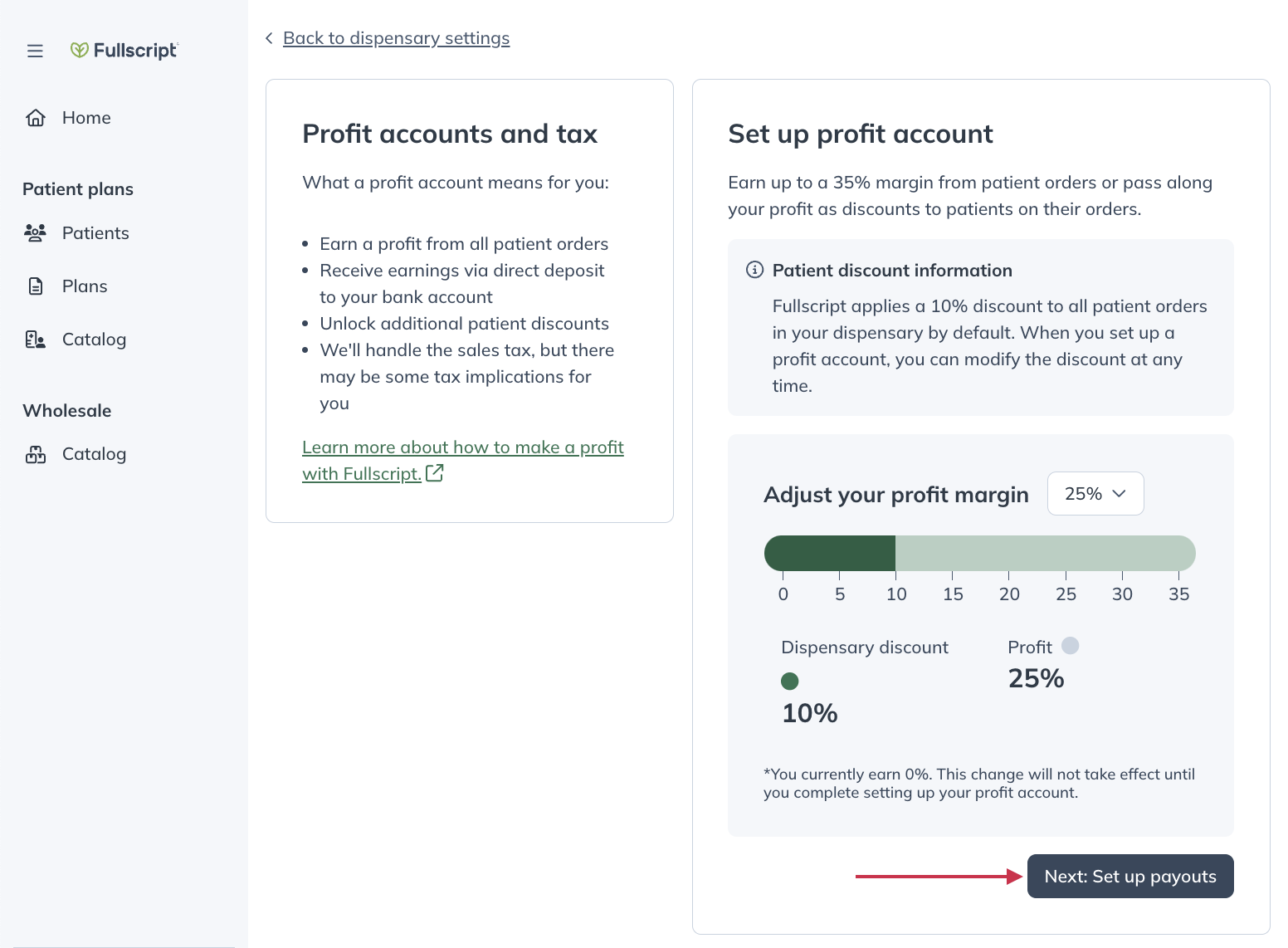

New accounts are no-profit by default, and patients receive a 10% discount on all orders through your dispensary. However, you can follow the steps below to start making a profit, enable direct deposit payouts, and unlock additional discount capabilities.

To set up a margin account:

- From the practitioner menu, select Set up a margin account.

- On the Business financials page, select a profit margin (%) and dispensary discount. Increasing the dispensary discount that applies to patient orders reduces your profit margin and vice versa. You can update your profit and dispensary discount any time by returning to this page.

- Select your Business type and complete all required fields to provide your tax information. This is used to verify your identity and set up an account with our payment processor (Stripe). Select Individual if you’re not affiliating your dispensary with a business.

- Further down the page, add a bank account to authorize direct deposit payouts.

- Review Stripe’s Connected Account Agreement, then select Become a profit account from the bottom of the page to submit.