Last modified: December 18, 2025

US dispensaries: Form 1099-K E-delivery consent

Providers

Practitioners can now consent to electronic delivery (E-delivery) of Form 1099-K. This guide will walk you through the process and the benefits of opting for electronic delivery.

Understanding E-delivery for Form 1099-K

About Form 1099-K

Form 1099-K is a tax form used in the United States to report certain types of payment transactions, primarily those related to electronic and online payment processing. It’s issued by payment settlement entities, such as payment processors (e.g., Stripe) or third-party platforms, to dispensary owners and submitted to the IRS (as well as some US states).

Fullscript is required to provide Stripe with the tax details of our users by January 31st, enabling Stripe to issue 1099-K forms to practitioners who meet the eligibility thresholds for the given year. Form 1099-K is generated using the practitioner’s legal business name, Taxpayer Identification Number (SSN or EIN), and address.

The option for E-delivery

Dispensary owners now have the option to receive Form 1099-K electronically. This alternative allows you to securely access and download these forms online rather than receiving them through traditional mail services.

How to consent to E-delivery

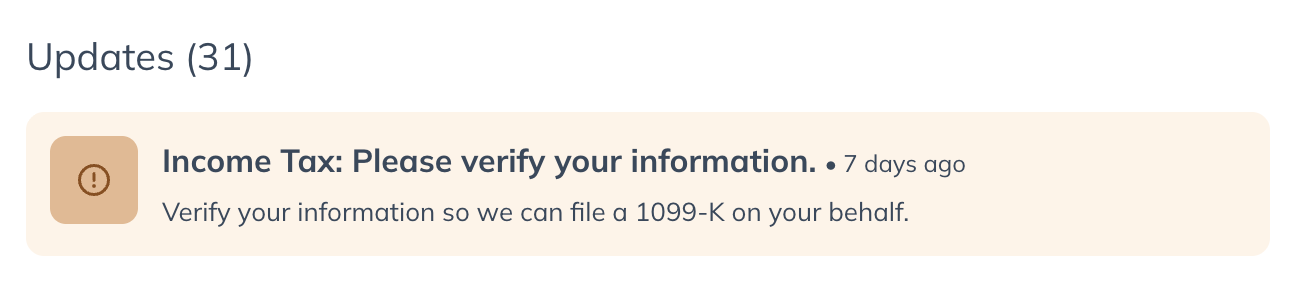

As tax season approaches, a banner will be enabled for all users who haven’t previously consented to E-delivery. To consent to E-delivery:

- Select the tax verification notification within the updates section on your homepage.

- Click on Verify your tax details and follow the modal.

- After verifying your tax information, select E-delivery, then Next in step 3.

- Read the full disclosure, select I agree, and click Done. The Tax Verification notification should disappear.